Dubai Real Estate Market Trends – Q3 2025 Outlook

The Dubai real estate market continues to demonstrate resilience and investor appeal into Q3 2025. Residential prices across prime

We provide valuation, advisory, and agency services for all types of office assets — from individual units to large-scale Grade A towers. Our team brings proven expertise and a strong track record across the region.

Whether you're an investor, lender, or owner-occupier, our team offers expert residential valuation and consultancy services, backed by deep market knowledge and regional experience.

From luxury hotel chains to boutique developments, we deliver tailored valuation and advisory services for hospitality assets across the region, supporting operators, developers, and investors.

We offer valuation and advisory services for retail, leisure, and entertainment assets, helping clients make informed decisions across leasing, investment, and development.

Our team provides strategic valuation and advisory support for industrial, logistics, and manufacturing assets — including acquisition, disposal, asset management, and financial reporting.

We deliver specialized valuation and advisory services for healthcare and education assets, focusing on value enhancement, strategic acquisitions, and long-term investment planning.

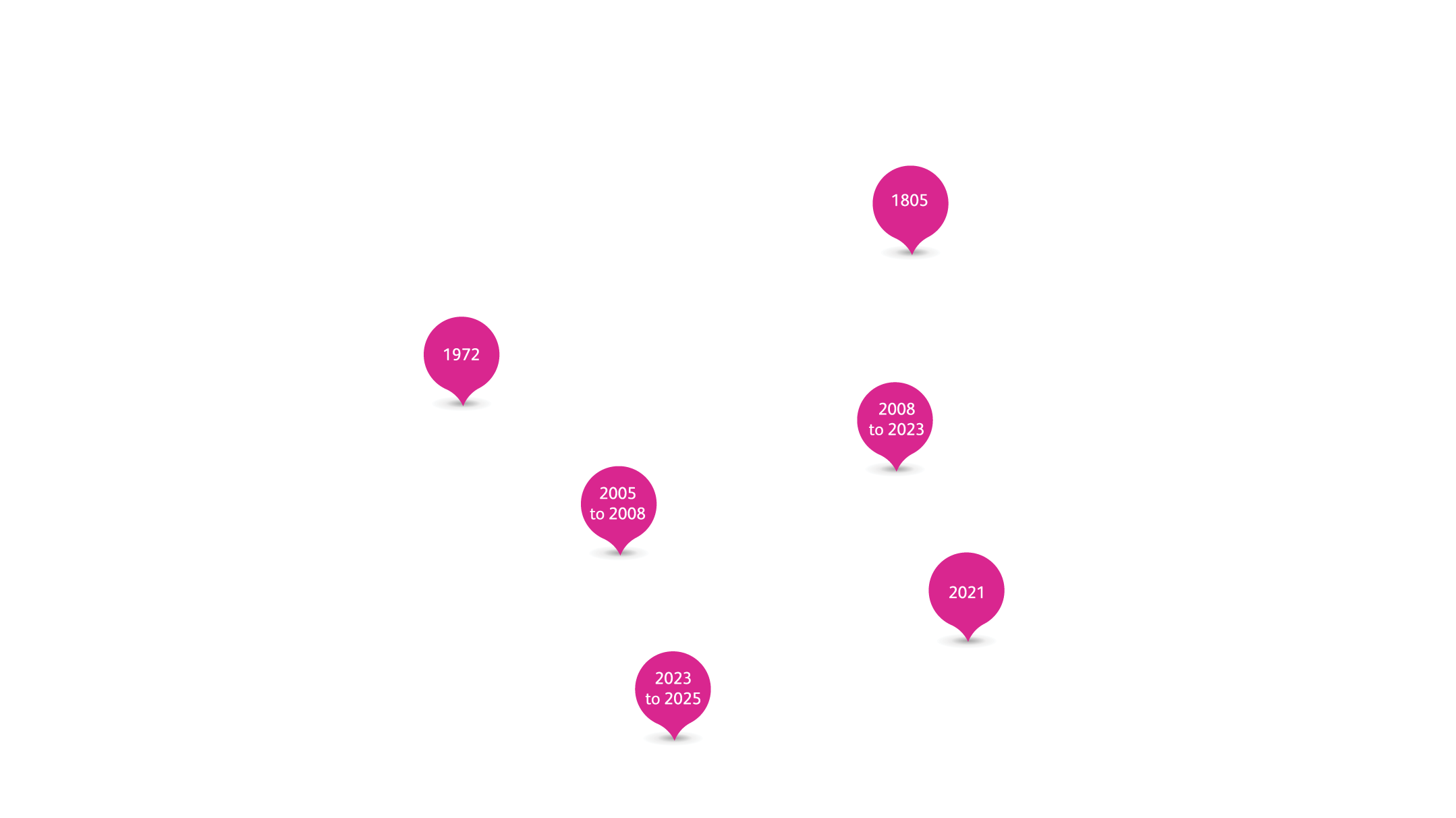

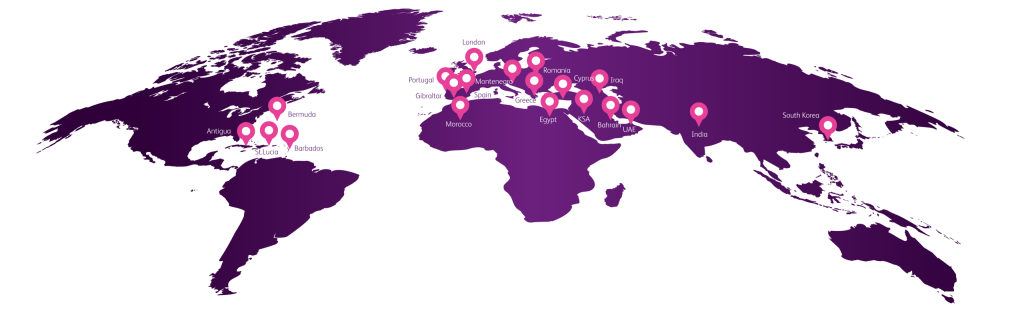

Driven by regional experience and international expertise, we deliver clear, strategic advice backed by a strong project track record.

With 80+ professionals across 4 regional offices, we deliver end-to-end real estate services across all asset classes.

Our cross-functional teams work seamlessly to provide end-to-end real estate solutions aligned with client goals and best practices.

With 4,500+ professionals worldwide and a growing MENA presence, we combine global standards with strong local market expertise to deliver exceptional results.

Chestertons MENA was instructed to provide a valuation of DREC’s land bank portfolio consisting of approximately 138 freehold and leasehold properties across the UAE. The valuation was required for financial reporting purposes.

Chestertons MENA was instructed to provide a valuation of Lootah Real Estate Development LLC’s storage warehouse with offices in Dubai World Central, Dubai. The valuation was required for financial reporting purposes

Chestertons MENA was instructed to provide a valuation of DMCC’s land bank portfolio consisting of approximately 40 freehold and leasehold properties across the UAE. The valuation was required for financial reporting purposes

Chestertons MENA was instructed to provide a valuation of ICT’s real estate portfolio consisting of approximately 130 mixed-use buildings and land plots across the UAE. The valuation was required for secured lendingpurposes with various banks.

Chestertons MENA was instructed to provide a valuation of AGRE’s portfolio consisting of approximately 100 land plots across the UAE.The valuation was required for financial reporting purposes.

Chestertons MENA was instructed to provide a valuation of Galadari’s portfolio consisting of approximately 20 land plots, and residential/commercial properties across the UAE.The valuation was required for secured lending purposes.

Chestertons MENA was instructed to provide a valuation of Al Hilal Bank’s real estate portfolio consisting of over 1,500 properties across the UAE. The valuation was required for year-end accounting purposes.

Chestertons MENA was instructed to provide a valuation of Habib Bank’s real estate portfolio consisting of over 591 mixed-use properties across the UAE. The valuation was required for year-end accounting purposes.

Chestertons MENA was engaged to value Union National Bank’s UAE real estate portfolio, comprising 530+ properties, including villa compounds, towers, hotels, and schools. The valuation supported year-end accounting.

Chestertons MENA was instructed to provide a valuation of Amlak Finance’s real estate portfolio consisting of over 370 mixed-use properties across the UAE. The valuation was required for year-end accounting purposes

Chestertons MENA was appointed for the third year to value nearly 100 Bukhatir Group properties, including educational, industrial, residential buildings, and development land for year-end accounts.

Chestertons MENA was instructed to provide a valuation of FAB’s real estate portfolio consisting of over 90 residential properties in Dubai. The valuation was required for year-end accounting purposes

Chestertons MENA was instructed to provide a valuation of Commercial Bank of Dubai’s real estate portfolio consisting of over 130 mixed-use properties across the UAE. The valuation was required for year-endaccounting purposes.

Chestertons MENA was instructed to provide a valuation of Mismak’s real estate portfolio consisting of approximately 80 mixed-use buildings and land plots across the UAE. The valuation was required for year-end accounting

The Dubai real estate market continues to demonstrate resilience and investor appeal into Q3 2025. Residential prices across prime

Chestertons MENA has been appointed to conduct a comprehensive valuation of over 400 assets across Dubai and Abu Dhabi

This mid-year report analyzes key valuation data across residential, commercial, retail, and industrial sectors in Dubai. Key findings include: